The fourth quarter brought some relief to investors as most asset classes experienced strong rallies. On the equity front, major North American indexes were up roughly 5-7% while the MSCI World index rallied 9.4%. The recovery in Q4 was welcome news after a disappointing year during which both the S&P500 and the MSCI World index fell roughly 20%. With rising costs and slowing growth, the technology sector was hit the

hardest, falling 33% last year (NASDAQ) and failing to regain much ground in Q4.

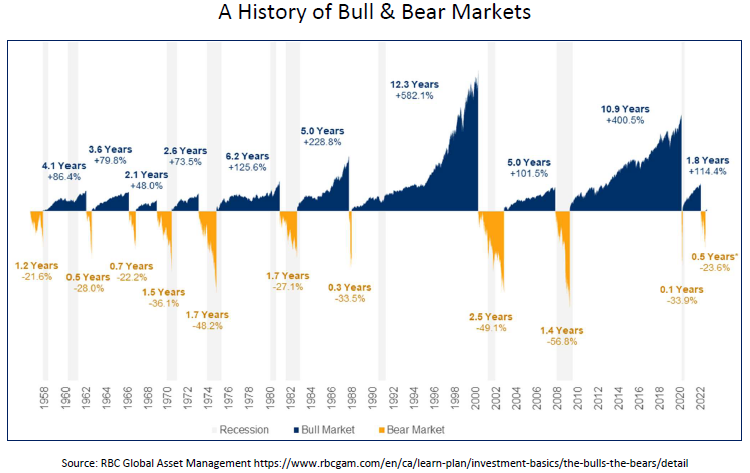

We have spoken at length about inflation, and the effects of central bank policy aimed to curb inflation. Consensus now points to a pause in aggressive central bank behaviour, and investors are eager to recoup losses from 2022. This is a good time to use history as our teacher and assess what may lie ahead. A “Bear Market” is loosely defined as period where a public index falls by 20% or more. A Bull market is the opposite. 2022 represented the 11th time this has happened since the mid 1950’s. Bull markets follow Bear markets, typically last several years longer, and significantly out perform their counterpart in the opposite direction.

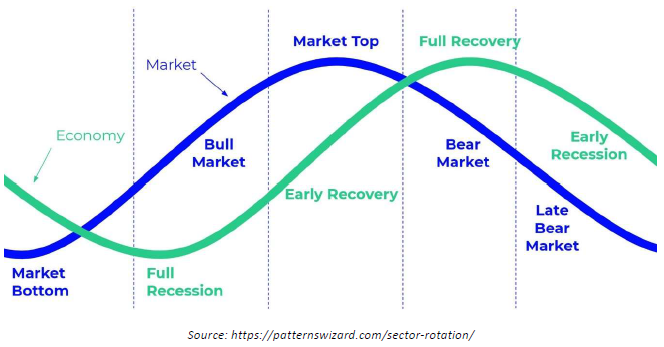

In Q1 2023 the conversation will likely shift to a possible recession. Again, we must use history as our teacher. A common misconception amongst investors is that the economy and the stock market function in tandem. In fact, there is typically a lag between the two. Markets are usually a leading indicator of a looming recession, but also tend to lead an economic recovery. With 2022 behind us, and interest rate hikes set to come to an end, it is likely that money will flow back into stock markets in 2023. News headlines over the next few months may focus on rising unemployment and falling real estate prices, meanwhile the next Bull market for equities may already be underway.

We believe there is tremendous opportunity in the marketplace today and we are excited. Our portfolio management team is focused on growth strategy for 2023, looking for opportunities to average down cost on some of the names we own, as well as adding new ones to our roster.

-The Gilman Deters Team

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by HarbourfrontWealth Management Inc.”

This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.