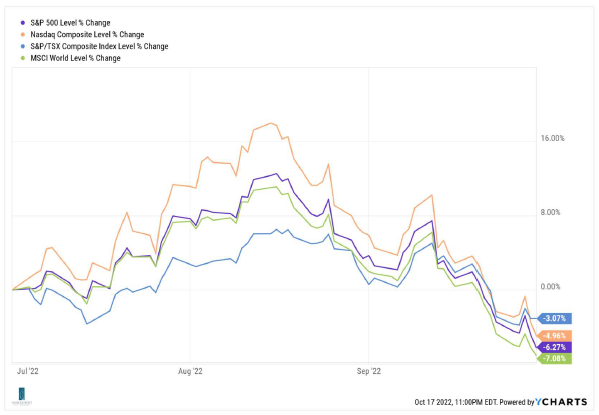

The month of July, and some of August, offered a brief reprieve from the Bearish sentiment that has dominated public markets since the beginning of the year. Unfortunately, for most investors, that reprieve did not last and capital flowed back to treasuries and other short term instruments. By September 30th the most broadly held Balanced funds in Canada were down over 14% on the year.

When investing in individual companies our portfolio management team is not guided by near term market volatility, rather by the potential for the individual companies we own to generate revenue and grow earnings. Occasionally we seek opportunities to capitalize on market weakness (or strength) by adding to or trimming from the names that we own. What we see today is a market of opportunity, but also one that requires patience. The global economy is adjusting to a new reality: one where money is no longer cheap, and neither are goods or services. That said, public markets may have priced in a more severe recession than is before us. Companies are still hiring, and economies are still expanding rather than contracting. The consequences of overspending will certainly come home to roost for many people in the coming months, but the fundamental underpinnings of our economies in North America are robust. We anticipate some continued equity volatility in the near term, with a strong recovery in the medium term. Meanwhile earnings season is upon us, which gives us a great opportunity to sensibly evaluate the companies we own as well as the ones that we don’t. There are lots of attractive names out there for the taking and good things come to the disciplined and patient.

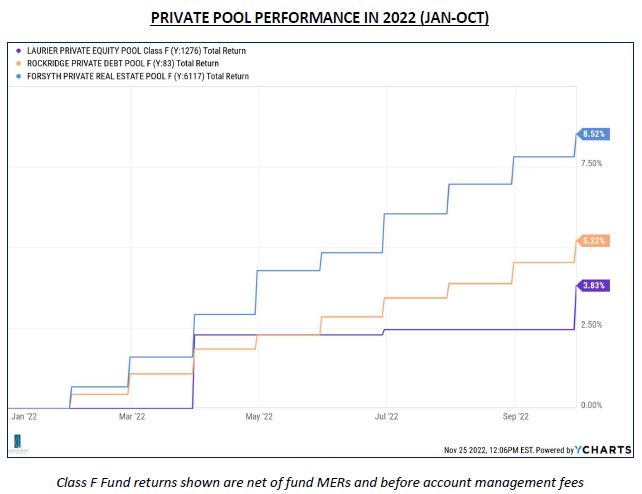

Finally, our three Private Investment Strategies posted positive results again in Q3 2022: Rockridge Private Debt returned 1.7%; Forsyth Private Real Estate 2.35%; and Laurier Private Equity 1.34%. The chart below reflects the performance of these 3 pools from January 1st to October 31st this year.

-The Gilman Deters Team

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by HarbourfrontWealth Management Inc.”

This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.