After a strong month of October, volatility roared back into equity markets in November and December. The S&P 500 delivered 9.4% in the 4th Quarter while the TSX delivered 6.91%.

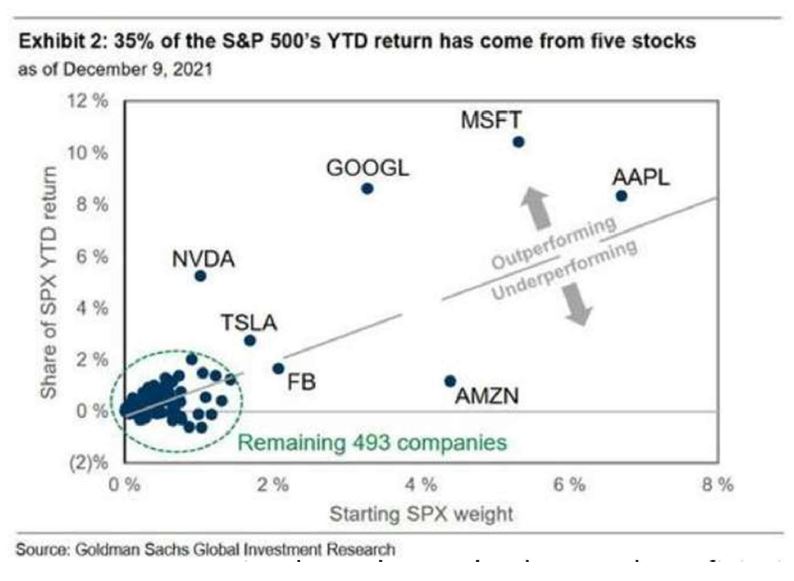

Mega-cap companies have been the largest beneficiaries of easy monetary policy as they have soaked up most of the liquidity. Looking back at 2021, an analysis completed by Goldman Sachs shows that the majority of the growth on the S&P 500 was attributed to the 5 most popular technology companies: Apple, Google, Microsoft, Tesla, and Nvidia. As Price Earnings multiples expanded, we watched these companies become increasingly more expensive and fundamentally overvalued.

In Canada, it’s not difficult to look at the performance of the TSX in 2021 and understand where the growth came from. The iShares Capped TSX Energy index rose over 80% in 2021. With a post-COVID global economic recovery well underway, Oil demand has picked up considerably thus driving energy prices higher. Despite the recent spike, we have strategically avoided this sector. Hydrocarbon-based energy has been a losing investment for over 6 years. The sector faces continued pressure from international climate action as well as the rapid adoption of Electric Vehicles and renewable energy. While demand is increasing in the near term, we do not expect the trend to continue in the medium-long term.

Much anticipated announcements by Central Banks in Q4 confirmed that inflation continues to run high and the end of stimulus has arrived. Both the Bank of Canada and the US Federal Reserve Bank have stopped injecting money into the financial system, paving the way for a series of interest rate hikes in 2022. This policy shift may have a dampening effect on equity returns in 2022 and will most certainly spell trouble for Bond investors.

While this commentary is written with a backward-looking perspective, we would be remiss to not to acknowledge the state of markets currently. During the month of January markets turned sharply negative, led down by some of the very companies that led the market up in 2021. The NASDAQ fell as much as 19% on January 26th, barely escaping “Bear Market” territory. With earnings season now upon us, some of the largest companies in the marketplace have delivered weaker than expected results, driving their stock price down as much as 25% in the cases of Meta (Facebook) and Paypal. Investors are digesting the “tightening” language from Central Banks and trimming back on high growth positions.

We have taken advantage of these recent developments by looking for opportunities to deploy cash where stocks are oversold and have also increased the weighting of Canadian Banks in our portfolios.

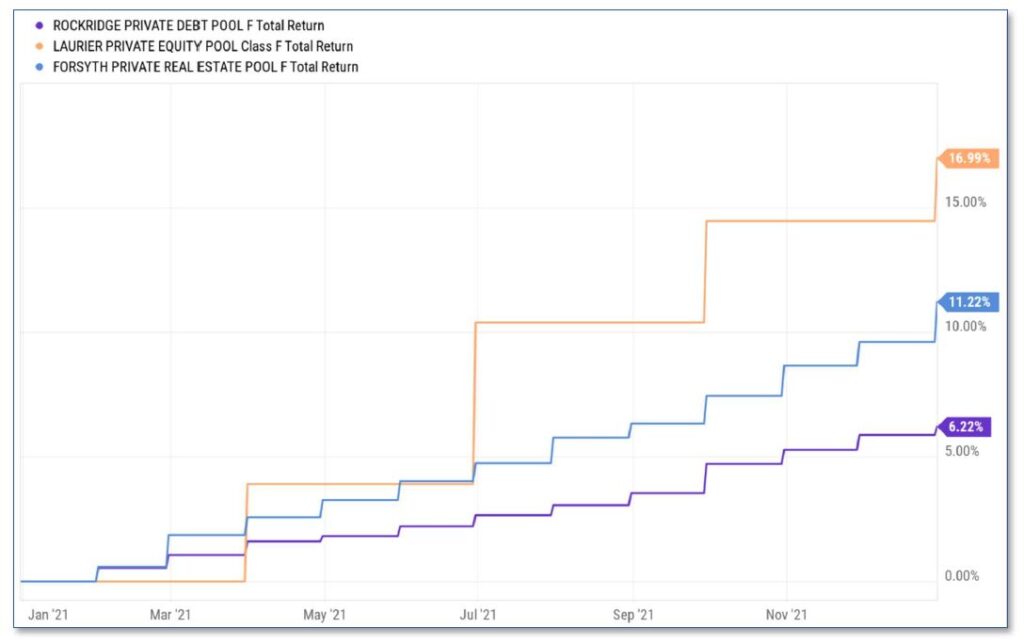

Finally, our commitment to Private investments remains a unique strength in our approach. Private investing is not immune to risk, nor prevailing economic circumstances, however, it has demonstrated immunity to irrational investor behaviour which reduces volatility in portfolios. Harbourfront’s industry-leading Private investment pools continue to offset public volatility and deliver positive results for unitholders. In 2021, the Rockridge Private Debt pool returned 6.22% while public bond indexes (XCB & XBB) fell 1.8-2.8%. The Forsyth Private Real Estate portfolio returned 11.22% on the year, and the Laurier Private Equity pool delivered 17% in only 11 months.

-The Gilman Deters Team

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by HarbourfrontWealth Management Inc.”

This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.