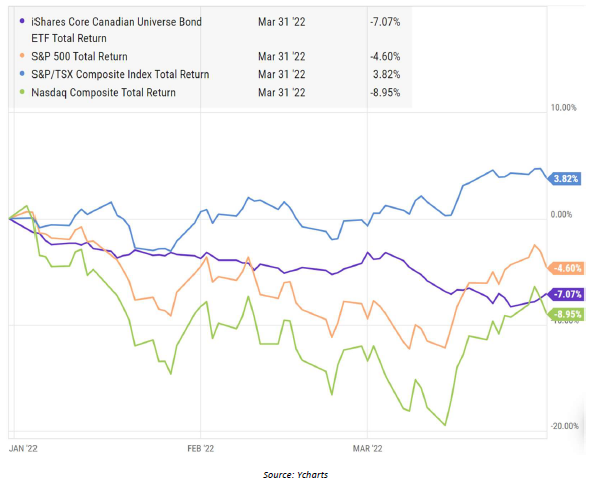

Our last commentary touched on the dramatic drop in global markets that occurred in January, as investors began to digest the removal of monetary stimulus from the system by central banks. After a brief reprieve from the indiscriminate selling in January, the picture again turned negative as Russia’s impending invasion of Ukraine become ever more apparent. When all was said and done it was one of the poorest starts to a year for global stocks as the S&P500 fell 5.7% in CAD in Q1 (after being down approximately 13.0% from peak to trough). Alternatively, Commodities, Oil & Gas, and Canadian banks rallied during the quarter allowing the more resource and cyclically focused TSX Composite to end with a 3.8% gain. Meanwhile, Fixed Income investors continue to be punished for investing in “safety”. While inflationary pressures continued to reduce the purchasing power of a dollar, the Canadian Universe Bond Index (XBB) fell more than 7.0%.

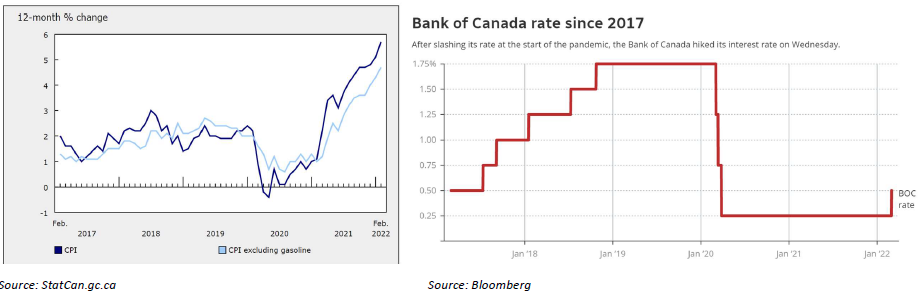

On the broader subject of the economy, inflation touched 5.7% in February. We have all felt this not only at the gas pump, but in housing, food prices and most raw materials which have pushed up costs on everything from vehicles to home renovation projects. Governments and Central Banks flooded the economy with monetary stimulus during COVID and are now struggling to curb a level of inflation which hasn’t been seen in

Canada since 1991. The March 2nd interest rate hike is considered to be the first of many, as the Bank of Canada will now likely embark on a path of rate hikes even more rapid than we saw in 2017/2018 (pictured below). Although housing activity is already slowing across the country, it is yet to be seen how increased costs will affect Canadians’ willingness to resume travelling this summer in a Post-COVID world. Eventually,

high commodity prices in conjunction with higher interest rates should hit consumer spending and likely result in a recession 12 to 18 months down the road.

In consideration of all of the above, our portfolio management team was very active in Q1. We deployed excess cash where available into some of our harder hit companies, as well as taking positions in the TSX60, US Oil, and reducing our exposure to the US Dollar. Although final performance numbers from our private investment pools were not available at the time of writing this commentary, we anticipate that all three were net positive contributors during the quarter.

-The Gilman Deters Team

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by HarbourfrontWealth Management Inc.”

This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.