So much has happened since our last Quarterly update, it is hard to compile these thoughts into a concise message. When the year began, we were all marveling at the images of Chinese construction workers scrambling to build an entirely new hospital in just seven days. “How could they accomplish such an incredible feat in such a small amount of time?” Taken aback by the “how”, many of us were distracted from understanding “why”, and what would ultimately follow.

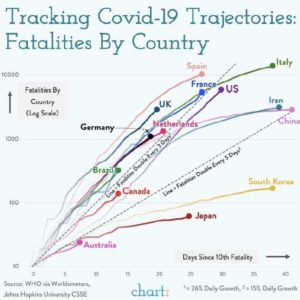

When the year began, the Corona virus was barely even a Pan-Asian issue. By the end of January cases were popping up all over the globe, and by March 12th the WHO officially declared COVID-19 a global Pandemic. In a matter of weeks, a seemingly localized problem in one Chinese province has become an unprecedented Global event that has isolated us, yet interestingly also connected us. There is a level of commonality amongst

When the year began, the Corona virus was barely even a Pan-Asian issue. By the end of January cases were popping up all over the globe, and by March 12th the WHO officially declared COVID-19 a global Pandemic. In a matter of weeks, a seemingly localized problem in one Chinese province has become an unprecedented Global event that has isolated us, yet interestingly also connected us. There is a level of commonality amongst

us all these days, that we never expected. For the first time in our lives, the world is committed to a singular cause.

As countries grapple with controlling the spread of the virus, this unprecedented healthevent has also led to an unprecedented economic event. Some of us are fortunate enough to be able to continue our jobs from home. Others are not so fortunate, as small businesses everywhere have been forced to shut down to protect the ones we love. The effect on our economies will be substantial, and stock markets are quick to remind us of that. Markets fell sharply in Q1 2020. At the end of it all, the S&P 500 and the TSX Composite had fallen 20% & 21% respectively. To make matters worse for some, a dispute between Russia and Saudi Arabia led to a substantial increase in Oil production at a time when global demand was falling fast. As a result, a barrel of Canadian Oil today costs slightly less than a Big Mac meal at McDonald’s. The situation for families in Alberta and Saskatchewan is very dire indeed.

While we are not immune from this environment, we are proud of our response. Owning great companies, having a bias towards the US dollar, increasing our cash position, and allocating money to private investments are all examples of actions we have taken to protect our clients from most of this volatility. After surveying the lackluster performance of some of the largest mutual funds in Canada, we are confident that our approach has paid off.

The great debate amongst investors today, is where things go from here. The question is not “Will” markets recover, but “When” and “How long” it will take. Comparisons are not only being drawn to the Global Financial Crisis of 2008/09, but also to Y2K, 1987, and the Great Depression. In the last week of March, markets began to rally. Our current belief is that markets are rallying on headlines and hope, rather than

understanding the full economic impact to follow.

We believe that, although the various government stimulus measures to this point have been enormous, the cost will far exceed what has been announced thus far. We believe that in the medium term, this pandemic will be a catalyst for positive change. In the near term, however, we believe that companies will begin to report their earnings, and markets will resume a downward path heading into the summer.

To borrow from one Chief Investment Strategist in Canada yesterday – “We will see better times. But…the initial condition for a significant strategic shift away from defensive portfolio posturing probably requires a bottom in the economic outlook. There are still no signs of that bottom.” – Myles Zyblocki

In determining our investment strategy for the coming months, it is important to consider which sectors of the economy stand to perform better than others. One of the ways we are viewing stocks right now is by categorizing companies into four groups:

We expect more clarity in the coming weeks. For now, we are comfortable maintaining a defensive posture.

It’s nearly 7:00pm in BC now, and time to head outside to cheer on our Health Care and frontline workers that are making sacrifices to look after our loved ones. It’s also the anniversary of Vimy Ridge today. So wherever you are, we hope that you are safe, that your loved ones are healthy, and that you will join us in feeling grateful for today and hopeful for tomorrow. Take great care.

Thank you for your continued support.

-The Gilman Deters Private Wealth team

i – Myles Zyblock, Dynamic Funds. Insights on Recent Market Events – April 8 2020.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by HarbourfrontWealth Management Inc.”

This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.