A year to remem…..forget?

2020 has come and gone. What a wild and weird year it was – one that will most certinaly be remembered as a year to be forgotten.

After global markets suffered a major shock amid the early stages of the COVID pandemic, stock prices rallied through the back half of the year. In the fourth quarter, the S&P 500 (CAD) rose 6.61% and the TSX Composite gained 8.97%. Meanwhile, the COVID pandemic has raged on. Phenomenally, the US market appears immune to this virus. US mega-cap companies, most notably technology companies,

have carried the S&P 500 to record highs.

While we have undoubtedly embarked on a real paradigm shift from being in the workplace to being at home, technology is not solely responsible for the rally. Global governments, and Central Banks continue to leave an elephant size footprint in markets, with stimulus continuing to flood the system and the hot money working its way into stocks. A short but sharp round of interest rate cuts and a huge increase in money supply have spurred a massive move in global stocks.

Consequently, Bond Indexes were again relatively flat on the quarter. As Central Banks try to ignite growth by flooding economies with money, the longer-term risk is a return of inflation, which should drive bond prices lower.

Also trending lower is the US dollar. The Canadian dollar (CAD) continued to appreciate during the quarter, in conjunction with a rally in the price of oil.

What comes next?

Again, we find ourselves in the position of being “cautiously optimistic”. On the one hand, US equities are more expensive than ever. In fact, the Risk Premium on the S&P 500 (what we can expect as compensation for being invested in stocks over bonds) is hovering near a multi-decade low. Meanwhile, many large corporations are thriving while small businesses are struggling. The disconnect between Wall Street and Main Street is growing ever larger. On the other hand, there are several indicators that should fuel growth in economies and

markets in the near term. As vaccines are distributed, consumer behaviour will improve. Meanwhile, cheap gasoline and low-interest rates will further stimulate activity. Travel will resume, trade will resume, and unemployment will normalize.

2021 Strategy

With such low-interest rates and the risk of bond prices falling, we continue to use and favor our private investment pools. In the Rockridge Private Debt Pool, shorter duration loans will provide inflation protection. In the Forsyth Private Real Estate Pool, multi-family apartment housing will continue to resist the type of stress that can be seen on retail and office space today. Both pools remain uncorrelated to publicly traded bonds and real estate, resulting in lower risk to portfolios.

On the equity front, we will seek to balance out the risk of our high growth positions with some discounted value positions. We continue to hold quality companies with earnings growth, strong balance sheets, and innovative products, that will outperform over the long run.

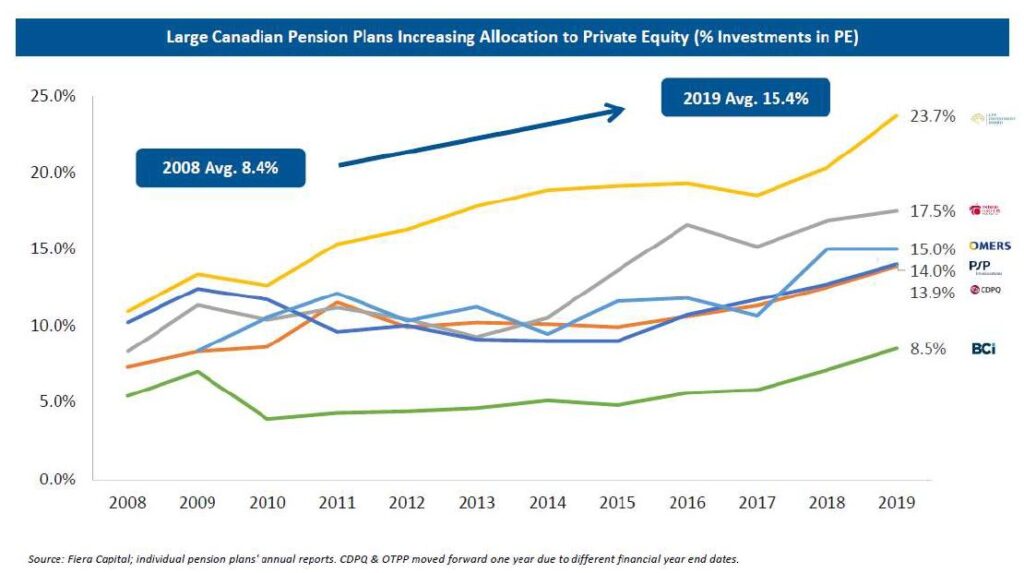

Most notably, Harbourfront is introducing our most exclusive alternative strategy yet – the Laurier Private Equity Pool. For well over a decade, global pension plans, endowment funds and high net worth investors have been flocking to the Private Equity space. There is no better example of this than right here in our own back yard. The table below depicts the consistent attention being paid to this space by every major pension plan in Canada. In fact, the Canada Pension Plan is the world’s largest single purchaser of Private Equity investments

today.

The Laurier Private Equity pool will seek to emulate this approach by investing in a variety of private strategies that deliver strong long-term growth with extremely low volatility. Moreover, it will stand alone as the ONLY RSP eligible Private Equity fund in Canada with Quarterly Liquidity. Those of you that are familiar with this space will appreciate that this is a truly unique accomplishment.

At Harbourfront, we are changing the face of retail investing in Canada. At Gilman Deters Private Wealth, we are here for you. Pandemic or otherwise. Thanks for your time and confidence, and best wishes to all of you for an improved 2021!

-The Gilman Deters Team

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by HarbourfrontWealth Management Inc.”

This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.