Public Market Highlights

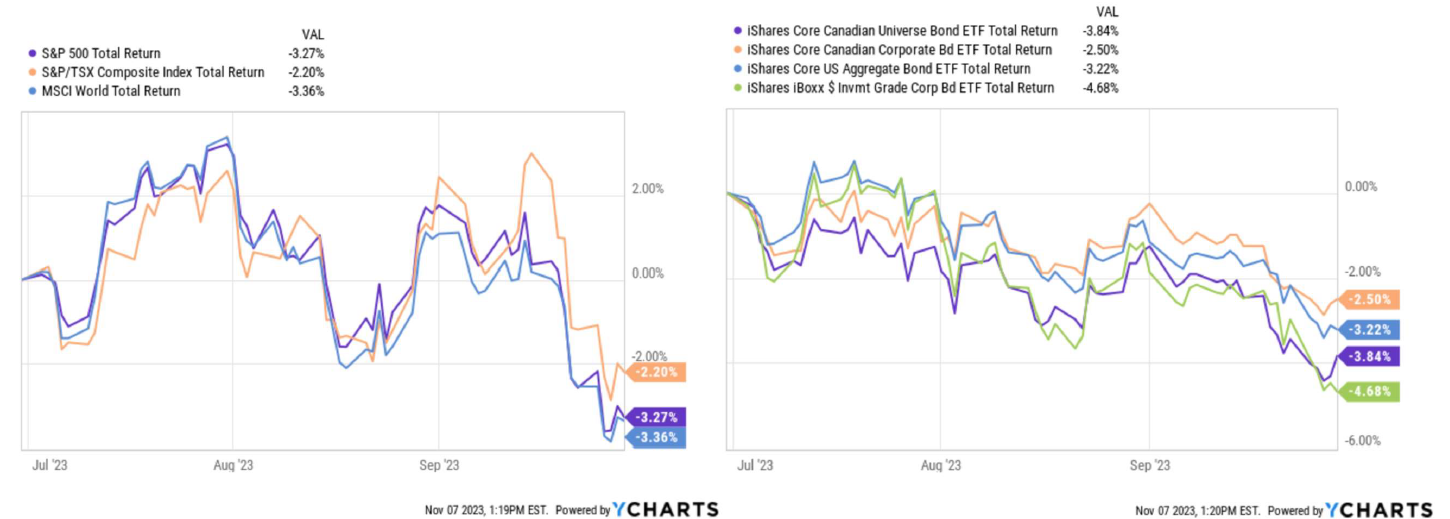

The third quarter was a quieter one for central bankers, as only one rate hiked was announced in each Canada and the US. Inflation numbers did not see much movement, and public investors responded by selling assets for fear of more hikes to come. Bond prices and equity prices in North America fell in Q3, meanwhile those investors with a private investment allocation in their portfolios faired better with less volatility.

Overall, the S&P 500 (in CAD) posted a sharp change of course, exhibiting a 1.25% decline primarily driven by headwinds from mega-cap technology companies, while the S&P/TSX Composite Index was down 2.20%. Persistent inflationary pressures, notably the price at the pump and high employment numbers, led to an unexpected rate hike by the Bank of Canada, impacting the Canadian bond market as higher rates put downward price pressure on bonds.

Economic Indicators

Early-quarter interest rate hikes initially led to lower bond prices; however, those losses were mitigated following a favorable US job openings report. On the economic front, America’s national debt reached a staggering $33 trillion, underscoring significant fiscal challenges. Meanwhile, Canada’s Consumer Price Index (CPI) rose 4% year-over-year, signaling persistent inflationary pressures. Higher interest rates, increasing government debt and the ongoing geopolitical landscape resulted in a cautious investing environment.

Private Markets

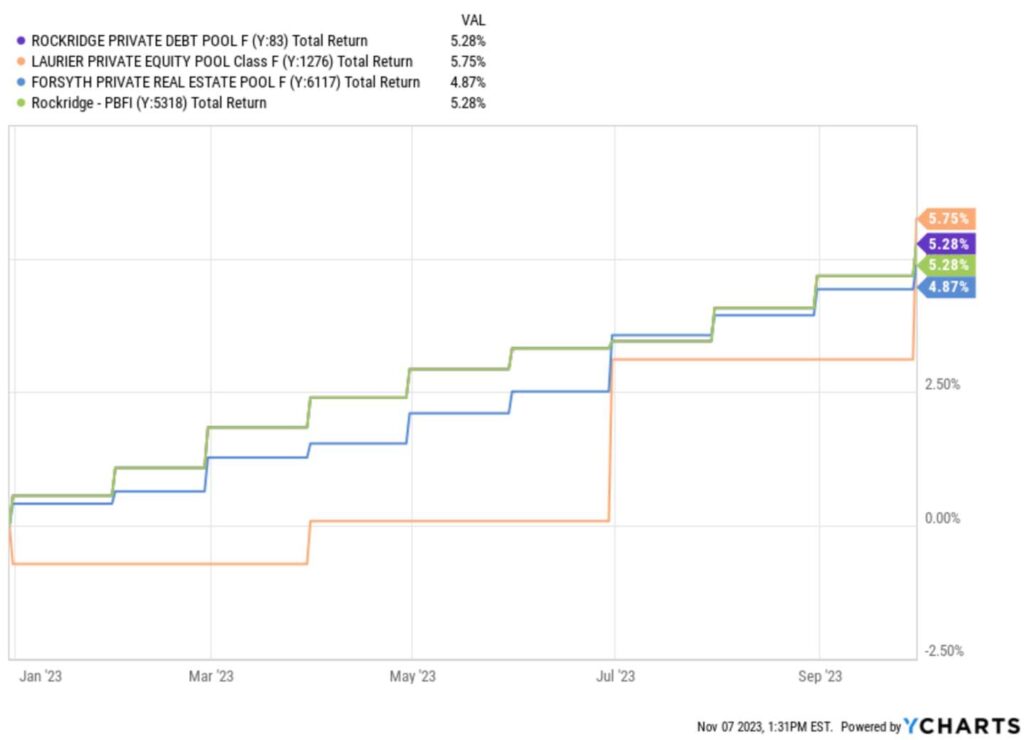

Private market activity also slowed in Q3. On the fundraising side many firms struggled to add capital to their already high levels dry powder. On the supply side of the equation, private credit continues to see an increase in deal flow from borrowers seeking an alternative to traditional lending. The trend of lighter capital raising with an increase in deal flow continues to shape a markedly different environment than we saw in 2021 when there has strong competition and increasing valuations. The market is undergoing rebalancing that should lay the groundwork for good a vintage year in 2024. Private Equity exits were down considerably from Q2, however the IPO market began to show signs of life with 39 companies coming to market raising $3.1 billion USD, the highest level since Q1 2021. Private Real Estate vacancies are increasing in both the office and industrial sub-sectors while residential and multi-family vacancies continue to decrease. Returns for the quarter in our three private pools were as follows: Rockridge Private Debt 1.77%; Forsyth Private Real Estate 1.27%; Laurier Private Equity 2.56%.

Portfolio Positioning

In response to the volatile market conditions, we continue to believe a defensive stance in the portfolios remains paramount. Emphasis remains on capital preservation and risk-adjusted returns, resulting in an underweight to equities and placing those proceeds short term high-interest cash investments earning 5%+. This positioning proved beneficial during the quarter, reducing drawdowns on the portfolios amidst a volatile

global equity market.

As we proceed into Q4 2023, the investment landscape demands a measured approach amidst rising interest rates and seasonal volatility. We are currently observing equity market levels to identify possible entry points and late-year participation in a bull market rally. The evolving landscape of higher interest rates and market dynamics requires a vigilant assessment, ensuring portfolios are positioned to navigate the uncertainties ahead, while being prepared to allocate back to equities when the coast is clear and volatility levels off. Meanwhile our commitment to our private investment thesis remains strong.

-The Gilman Deters Team

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.”

This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.